Educational Institutions

NYSAIS Consortium Success Story

Rye Country Day School – Scott Nelson, Head of School

Over the past 17 years the Business Office at Rye Country Day School (RCDS) has paid very close attention to the containment of medical insurance premiums for our group of approximately 140 participating employees, their spouses/partners, and dependents. This process has involved careful annual monitoring of our group experience, thorough research of plan options, and ultimately some difficult decisions. We balanced providing quality medical insurance, while maintaining two-party and family coverage (the norm in the Fairchester group of schools), in the face of rising medical premiums. The journey, which led to our joining the NYSAIS Healthcare Consortium, has saved the School and our employees hundreds of thousands of dollars while providing an extensive network of coverage for employees.

The Journey

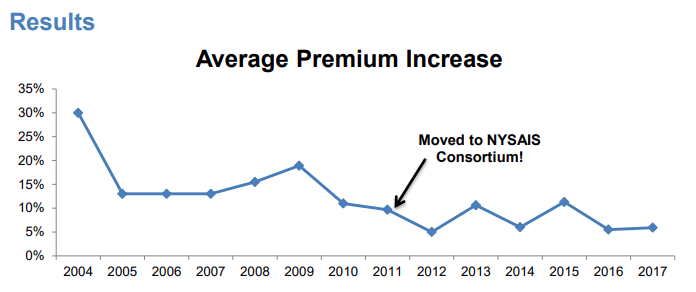

Up until 2004 RCDS offered the Oxford PPO plan that included in-network and out-of-network coverage to employees, spouses/partners, and dependents with the School paying 80% of premiums for single, two-party and family coverage, which was and still is the norm in the Fairchester group of schools. Faced with increasing premiums in 2004, we used a typical insurance maneuver and switched to a new carrier, Aetna, to contain premium increases; however, the next year was extremely unfortunate for our group with three major medical situations that resulted in a proposed premium increase of more than 30% or $303,000, for the following year. We seriously discussed eroding our Aetna coverage to lower the premium increase to 25% or $216,000, but were extremely concerned that such increases were financially unsustainable moving forward.

So, in July of 2005, we explored dropping out-of-network coverage and switching to an HMO plan to contain costs. A decision to switch to Empire's community-rated HMO, an in-network only plan, resulted in no premium increase, minimal disruption in doctor coverage, and saved at least $216,000 in premiums annually going forward. The loss of out-of-network coverage was a very significant change for some of our employees, but costs were contained and dependent coverage at 80% of premiums was protected. We stayed with Empire's community-rated HMO for 5 years and endured the average 13% community-rated market increases, feeling we at least were protected from the potentially devastating impact of just three or four major medical situations in our group of 140 participants. 01.23.2018

Joined the NYSAIS Consortium

In 2011 we learned of the NYSAIS Health Care Consortium that offered a variety of plan options ranging from a PPO with out-of-network coverage to a basic in-network only EPO plan, and eventually high-deductible health savings account plans. As a Consortium member school we could decide which of the six plan options we offered our employees and the level at which we would fund each option, while benefitting from a much larger group of 18 schools and 2,400 lives. There was safety in larger numbers and more negotiating leverage with insurance carriers.

We decided to join the Consortium and offered two plans: the EPO funded at 80% (single, two-party, and family coverage) and employees had the option to choose the PPO (out-of-network coverage) at their own increased expense. A few years later we added the HDHP EPO HSA option at 80% contribution.

Our experience has been extremely positive with no premium increase the first year we joined the Consortium followed by an average premium increase of only 6% over the next six years. For RCDS, every 1% saved in healthcare premiums is $30,000 available for other school expenses and lower annual premiums reduce the additional impact of compounding premium growth. Employees have a choice of three different plans in an extensive network, and they too benefit from the savings on their 20% portion of the annual premiums.

The NYSAIS Healthcare Consortium has proven to be a key strategic financial option for our school and our employees.